iRobot’s trajectory has a familiar American feel. Founded as an MIT research effort, the company popularized smart robotic vacuums but has now entered Chapter 11 bankruptcy, leaving its future largely shaped by the Chinese supplier that produced its hardware.

Founded in 1990 in Bedford, Massachusetts, by MIT roboticist Rodney Brooks and his students Colin Angle and Helen Greiner, iRobot spent over three decades journeying from the frontiers of AI research to millions of living rooms worldwide, only to file for bankruptcy protection this Sunday.

The company experienced a period of strong innovation and rapid growth before its decline was sped up by regulatory hurdles, competitive pressures, and an unsuccessful attempt to pivot.

From Insect Brains to a Household Verb

Brooks, a founding director of MIT’s Computer Science and Artificial Intelligence Laboratory, spent the 1980s studying insects, convinced that simple systems could produce complex, intelligent behavior. That insight became the foundation of iRobot, which would eventually sell more than 50 million robots.

The turning point arrived in 2002 with the launch of the Roomba. It quickly became more than a novelty, entering popular culture as a verb, a meme, and even a ride for household cats, proof that practical consumer robotics had finally arrived.

Momentum translated into funding. Following a $38 million raise from investors, including The Carlyle Group, iRobot’s 2005 IPO brought in $103.2 million. By 2015, the company had accumulated enough capital to establish a venture arm focused on early-stage robotics companies.

Then came what looked like a fairy-tale ending. In 2022, Amazon agreed to buy iRobot for $1.7 billion. For CEO Colin Angle, who had led the company since its founding, the deal appeared to offer a way to carry iRobot’s mission forward inside Amazon’s vast ecosystem.

That ending unraveled under regulatory scrutiny in Europe. Officials, worried that Amazon could leverage iRobot to tighten its grip on the smart home and crowd out rivals, moved to block the acquisition. In January 2024, the companies abandoned the deal, with Amazon paying a $94 million breakup fee.

What came next was rough. Angle resigned, the stock tanked, and nearly a third of the workforce was laid off. Without the Amazon deal, iRobot suddenly looked exposed, with no safety net left.

iRobot was struggling well before the deal fell apart. Earnings had been dropping since 2021, squeezed by messy post-pandemic supply chains and an influx of cheaper robot vacuums from China. A $200 million loan from Carlyle in 2023 bought some time, but not a turnaround, and Carlyle quietly sold that loan last month, probably at a loss.

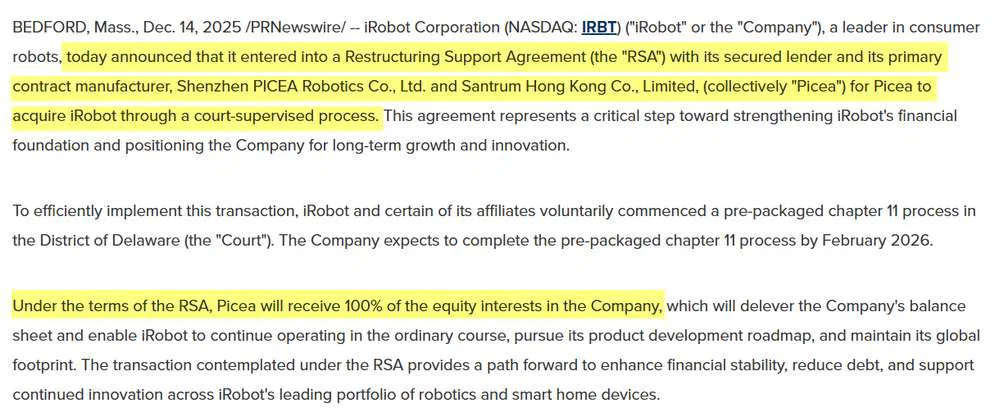

The long slide reached its endpoint on Sunday with a Chapter 11 bankruptcy filing. Control of the reorganized company will pass not to a tech giant, but to Shenzhen PICEA Robotics, iRobot’s primary supplier and creditor.

What Happens to Your Roomba Now?

In its announcement, iRobot sought to reassure customers that operations will continue as normal. The company said its restructuring plan would allow it to operate “in the ordinary course,” with no expected disruption to its apps, customer programs, or product support.

“To be clear, today’s news has no impact on our business operations or our ability to serve our customers, which continues to be our top priority,” spokeswoman Michèle Szynal told TechCrunch via email. “Our products are not changing.”

The legal paperwork tells a less confident story, raising doubts about whether suppliers will stick around, whether the process will hold together, and whether the company makes it through at all.

The potential loss lies in the features that defined its smart experience, including app scheduling, room-specific cleaning, and Alexa voice control. Without them, the device would function as a simple, manually operated vacuum.

The company that pioneered navigation technology now faces an uncertain future. Its next chapter, and the fate of its technological legacy, will be shaped by a reorganization plan and external decisions it no longer directs.

Maybe you would like other interesting articles?