According to a compelling analysis from Michael Nathanson, Alphabet, Google’s parent company, is increasingly positioned as the dominant force in the artificial intelligence landscape. Nathanson bases this conclusion on several distinct advantages: the company’s commanding lead in multimodal search, rapidly accelerating cloud growth, enhanced monetization for YouTube, and the long-term potential of its Waymo subsidiary.

The outlook for Alphabet has also brightened on the regulatory front. A recent antitrust ruling proved significantly less severe than many had feared, suggesting that the company’s most pressing legal challenges may be receding. At the same time, initial concerns that AI chatbots like ChatGPT would cannibalize traditional search appear overblown. Early data indicate that these tools are actually expanding overall search usage. Google’s own Gemini AI is gaining remarkable traction; prediction markets now assign it a 66% probability of being named the year’s leading AI model, a substantial lead over ChatGPT’s 16%.

The company’s cloud division underscores this competitive strength. With a projected growth rate of 33% for 2025, Google Cloud is outperforming the broader market. Its platform has become the infrastructure of choice for the AI elite, serving nine of the world’s top ten AI labs and nearly every major AI unicorn.

Beyond cloud, YouTube stands on the verge of a significant monetization leap, driven by new AI tools that will facilitate sophisticated brand partnerships and commerce integrations. Meanwhile, Waymo’s ongoing expansion across U.S. cities provides a valuable long-term growth option. Despite these positive catalysts, Alphabet’s stock continues to trade at a relatively attractive valuation compared to its historical performance and industry peers.

Google Cloud: Alphabet’s Emerging Powerhouse in AI

Increasingly, Google Cloud is being viewed as Alphabet’s strategic differentiator in the AI race. Under CEO Thomas Kurian, the division has reached a formidable $50 billion in annual revenue, firmly establishing it as a direct competitor to Amazon’s AWS and Microsoft’s Azure.

The evidence of its technological edge is persuasive. As noted, an overwhelming majority of top AI labs rely on Google’s platform. The company’s processing efficiency is a key advantage; it handles roughly twice the volume of AI tokens as its closest competitors in half the time, effectively quadrupling its output.

This superiority stems from Alphabet’s vertical integration. By developing its own custom tensor processing units (TPUs) and AI models like Gemini, the company maintains unparalleled control over its cost structure and performance metrics. This integrated approach is fueling robust growth: Google Cloud attracted 28% more new customers in the first half of the year, and existing clients are increasing their spending by 1.5 times when they adopt its AI tools. A contract backlog of $106 billion, with more than half expected to convert to revenue within two years, provides clear visibility into future growth.

Kurian points to several key drivers, including custom AI agents for specific industries. The scale of its operations is immense, processing five billion commerce transactions through its shopping agent. Its customer service AI has seen a tenfold increase in chat and voice interactions. As the business continues to scale, cloud margins are improving, yielding returns on years of strategic investment in custom silicon and software optimization. While enterprise adoption of AI is still in its early stages, Google appears well-positioned to capture a disproportionate share of this expanding budget.

A Strong Second Quarter Performance

Alphabet’s second-quarter results for 2025 show strength across its diverse portfolio. Revenue climbed 14% to $96.4 billion, powered by a 12% increase in search revenue and a 13% rise in YouTube advertising.

The momentum behind Gemini is particularly striking. The AI app now boasts over 450 million monthly users, and daily requests have surged 50% since the first quarter. Across its services, Google now processes nearly one trillion tokens monthly, a figure that has doubled since May.

The reach of its “AI Overviews” now extends to over two billion users globally. These summaries are not just popular; they are additive, driving a 10% increase in searches for the queries in which they appear. The multimodal features, which blend text and image-based search, are proving especially popular with younger users.

To support this explosive demand, Alphabet is accelerating its capital investments. Capital expenditure is expected to hit $85 billion this year, $10 billion above original estimates, with further increases anticipated for 2026 to build out the necessary server and data center capacity.

Despite these substantial investments and higher legal costs, the company held its operating margin steady at 32%. While quarterly free cash flow dipped to $5.3 billion due to the spending ramp, the trailing twelve-month figure remains robust at $66.7 billion. Alphabet ended the quarter with $95 billion in cash and marketable securities, returning $16.1 billion to shareholders through buybacks and dividends.

Assessing the Valuation

Looking ahead, analysts project a significant growth trajectory for Alphabet, with sales forecast to rise from $350 billion in 2024 to $600 billion by 2029. Over the same period, adjusted earnings are expected to expand from approximately $8.00 per share to $17.75.

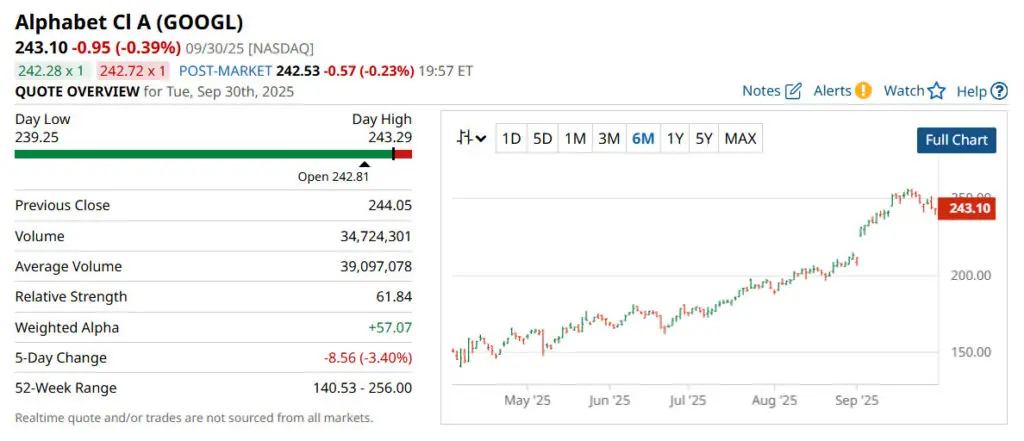

Currently, GOOGL stock trades at 24.8 times forward earnings, a slight premium to its 10-year average of 23.8. However, even applying a more conservative multiple of 20 times earnings to the projected 2029 earnings, the stock could trade around $355, implying a potential upside of 45% from current levels.

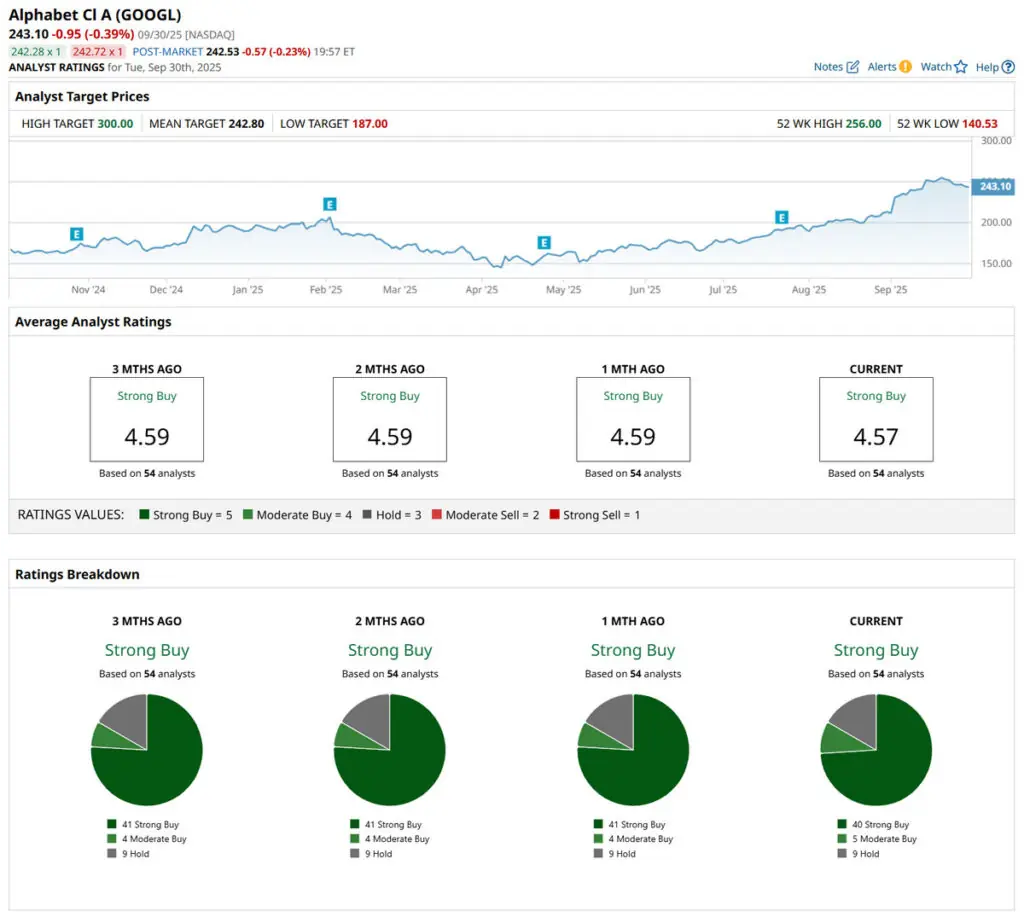

This optimism is reflected in the analyst community. Of the 54 analysts covering the stock, 40 issue a “Strong Buy” recommendation, with five advising “Moderate Buy” and nine suggesting “Hold.” The consensus price target sits at $242.80, aligning closely with the current trading price and suggesting that, despite recent gains, the market continues to see value in Alphabet’s long-term story.

Maybe you would like other interesting articles?