For years, the balance of power in desktop processors barely budged. But by the third quarter of 2025, the numbers told a different story. AMD had pushed its share to 33.6%, the highest in its history, rising a little each quarter, 1.4% here, 5.2% over a year, more than 10% since 2024. Intel held the larger share at 66.4%, yet the once-wide gap between the two was slowly closing, as reported by Tom’s Hardware using Mercury Research data.

A lot of this momentum comes down to the products people are actually buying. AMD’s Ryzen 9000 chips have been beating Intel’s Core Ultra 200 series all year, and the 9800X3D has been the star of the show. Gamers love it, it’s selling like crazy, and it’s getting more people to upgrade from 6 cores to 8. You can even see the shift in Steam’s hardware survey, where AMD has crossed the 40% mark.

Meanwhile, Intel’s top sellers are still the older Raptor Lake processors from a few years back. People in the industry say Intel hasn’t really put out anything that directly counters AMD’s 3D V-cache yet, which probably plays a role here. That could change once new Intel chips arrive.

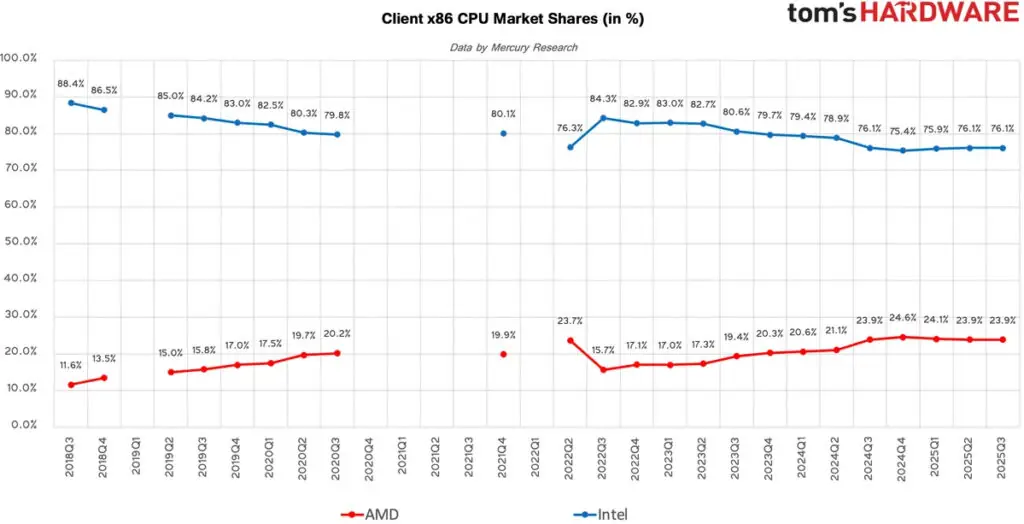

AMD’s gains go beyond desktop PCs. In the overall client x86 market, covering both laptops and desktops, the company hit 25.4% in Q3 2025. Tom’s Hardware says Intel’s slide to 74.6% is partly tied to supply problems. If you count embedded chips, IoT devices, and game consoles, AMD’s share jumps to 30.9%, about a 5% increase from a year ago.

AMD also picked up a bit of momentum in mobile chips, which is interesting since Intel had been doing pretty well there lately. Intel’s seasonal shipments didn’t land as strongly as expected, giving AMD a boost to 20.6% market share. Still, Intel managed to notch a slight year-over-year gain.

AMD also made steady progress in the server CPU market, gaining an additional 0.5% last quarter. While both AMD and Intel increased their server chip shipments year-over-year, AMD is seeing stronger benefits from the growing rollout of its Epyc Turin processors.

There’s one more interesting detail in the report. Even with the usual back-to-school rush and early holiday shopping, x86 CPU shipments in Q3 2025 didn’t really budge from the previous quarter. That’s pretty unusual for this time of year.

Maybe you would like other interesting articles?