The narrative of limitless financial innovation in blockchain is increasingly being challenged by market realities. Fresh analysis shows that by late 2025, over 50 percent of all cryptocurrencies ever issued had ceased to exist, with last year alone accounting for most of those failures.

According to a report from cryptocurrency data aggregator CoinGecko, of the over 20 million tokens launched between mid-2021 and the end of 2025, 53% are no longer traded. Their smart contracts remain etched on public block explorers, but they are effectively digital ghosts, lifeless and abandoned.

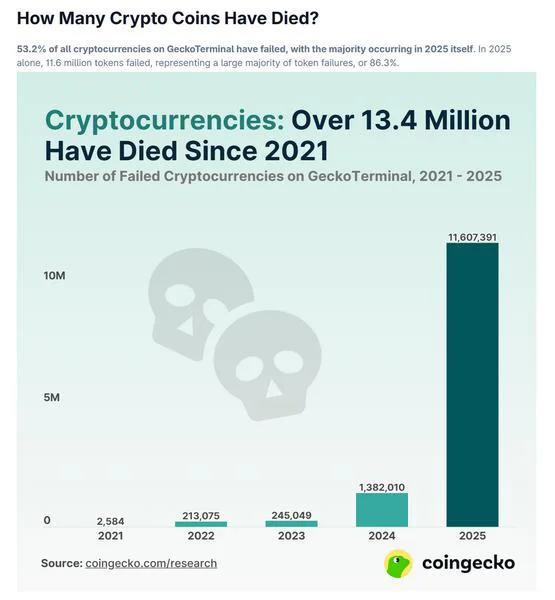

Rather than unfolding over time, the contraction intensified rapidly. Data shows that in 2025 alone, approximately 11.6 million tokens became inactive, accounting for 86.3 percent of all crypto project failures documented across the five-year analysis.

The underlying cause of the collapse lies less in technological failure than in incentive misalignment. Token creation has become nearly frictionless. Launchpads such as pump.fun allow creators to deploy assets within minutes, often without a product, development roadmap, or articulated utility beyond speculative trading.

CoinGecko analyst Shaun Paul Lee pointed out that making token creation easier came with a real tradeoff. The market quickly filled up with low-effort memecoins and speculative plays, a lot of which barely made it past their first few trades.

The impact became most severe in the final quarter of 2025. An estimated 7.7 million tokens failed between October and December, marking the sharpest three-month decline since 2021. This period overlapped with a significant liquidity shock on October 10, referred to as the “liquidation cascade,” during which roughly $19 billion in leveraged crypto positions were unwound.

The cascade sucked liquidity out of decentralized exchanges almost overnight, leaving a lot of shaky or purely speculative tokens with no way back. Lee called the October event the biggest deleveraging moment crypto has ever seen and a harsh reminder of how fragile things were after the bull run.

A longer-term view reveals a pattern of rapid yet increasingly shallow expansion. Just 2,584 projects went inactive in 2021. That number exceeded 1.3 million in 2024 and then spiked sharply in 2025. Notably, the data captures only projects that logged at least one trade, highlighting how many tokens fail almost immediately after launch.

Beneath the statistics sits a basic truth about permissionless blockchains. The openness that once powered experimentation now makes it easy to duplicate ideas endlessly. Somewhere along the way, token creation started to feel less like innovation and more like digital spam.

Tokens are now so easy to create that the networks, liquidity, and attention they depend on simply can’t keep up. The speculation that once powered growth now feeds on itself, minting endlessly while drifting toward irrelevance.

Finally, blockchain not only decentralized finance but also enabled failure to occur at unprecedented scale.

Maybe you would like other interesting articles?