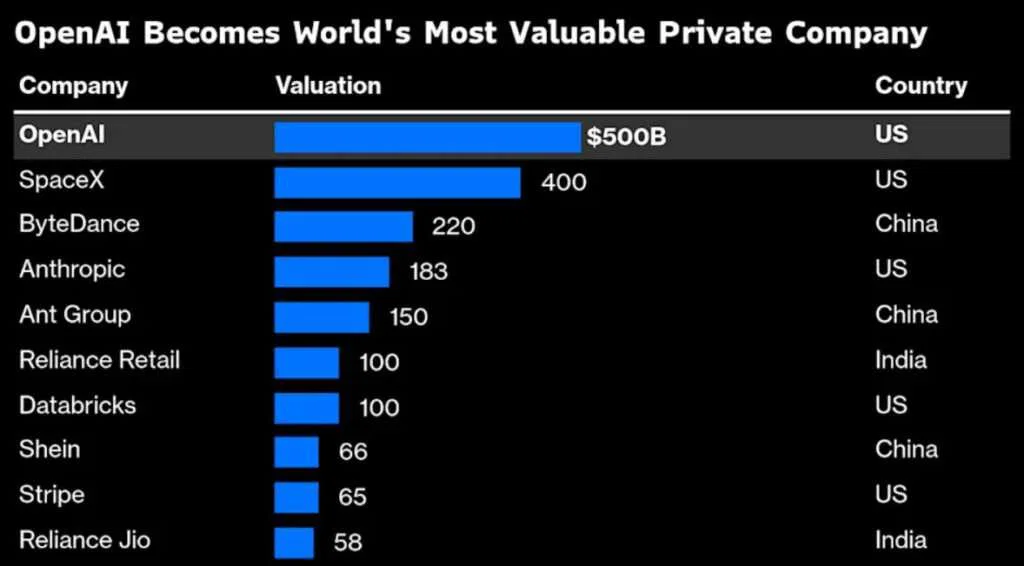

In a transaction that underscores its dominant position in the artificial intelligence sector, OpenAI has facilitated a major share sale for its employees, valuing the company at a staggering $86 billion. This valuation now places the creator of ChatGPT ahead of Elon Musk’s SpaceX, cementing its status as the world’s most valuable privately-held startup.

According to a source familiar with the matter, current and former employees were able to sell approximately $1 billion worth of their stock to a consortium of investors, including Thrive Capital, SoftBank Group Corp., Dragoneer Investment Group, and others. This deal represents a significant premium, lifting the company’s valuation well above its previous $30 billion mark set earlier this year.

This rapid highlights the intense investor enthusiasm for the companies at the forefront of generative AI, a technology widely expected to reshape entire industries. Under Sam Altman’s leadership, OpenAI is a central player in a global, multi-trillion-dollar effort to construct new data centers and develop advanced AI services. While the company itself is not yet profitable, it is actively fueling this infrastructure expansion through major partnerships with firms like Oracle Corp.

The transaction arrives at a pivotal moment for OpenAI. The company is currently in discussions with its primary backer, Microsoft Corp., to restructure itself into a more conventional for-profit entity. This proposed change is significant, as OpenAI was originally founded as a non-profit with a mission to develop AI for the benefit of humanity. The planned restructuring would see the original non-profit entity retain control over a new for-profit public benefit corporation.

This shift in corporate structure is not without controversy. Elon Musk, a co-founder of OpenAI who has since left the company, has filed a lawsuit challenging the overhaul. He alleges that OpenAI has strayed from its founding principles, particularly after accepting substantial investment from Microsoft.

Beyond internal governance, OpenAI faces fierce competition in the marketplace for top AI talent. Rivals like Meta Platforms Inc. are aggressively recruiting researchers, reportedly offering compensation packages that can reach into the millions. In this context, a secondary share sale serves a critical strategic purpose: it provides a tangible reward for employees, offering them financial liquidity and a compelling reason to remain with the company rather than pursue rival offers.

Such share sales are a common practice among major U.S. startups to reward and retain key staff. Interestingly, the source noted that the total amount of shares sold fell short of the total made available for the offering. This may suggest that many employees are choosing to hold onto their stakes, signaling a strong belief in the company’s long-term prospects.

Looking ahead, the competitive pressure is only intensifying. With well-funded rivals like Google and Anthropic also raising capital at a rapid pace, OpenAI is responding with a series of new product launches. This includes the recent release of powerful new AI models, and its most advanced system yet, GPT-4o, as it works to maintain its leadership in an increasingly crowded field.

Maybe you would like other interesting articles?