During a recent appearance on CBS News’ Face the Nation, Bank of America CEO Brian Moynihan said the bank hired 2,000 recent graduates this year from roughly 200,000 applicants. He noted that many young workers are beginning their careers feeling uneasy about the impact of artificial intelligence and their financial future.

“If you ask them if they’re scared, they say they are. And I understand that,” Moynihan told host Margaret Brennan. His advice to them was to channel that anxiety: “But I say, harness it … It’ll be your world ahead of you.”

The comments come as recent college graduates grapple with what has been widely described as a “hiring nightmare,” a view supported by Federal Reserve Chair Jerome Powell and labor economists. Although Moynihan struck an encouraging tone, the data points to a difficult job market for Gen Z seeking entry-level professional roles.

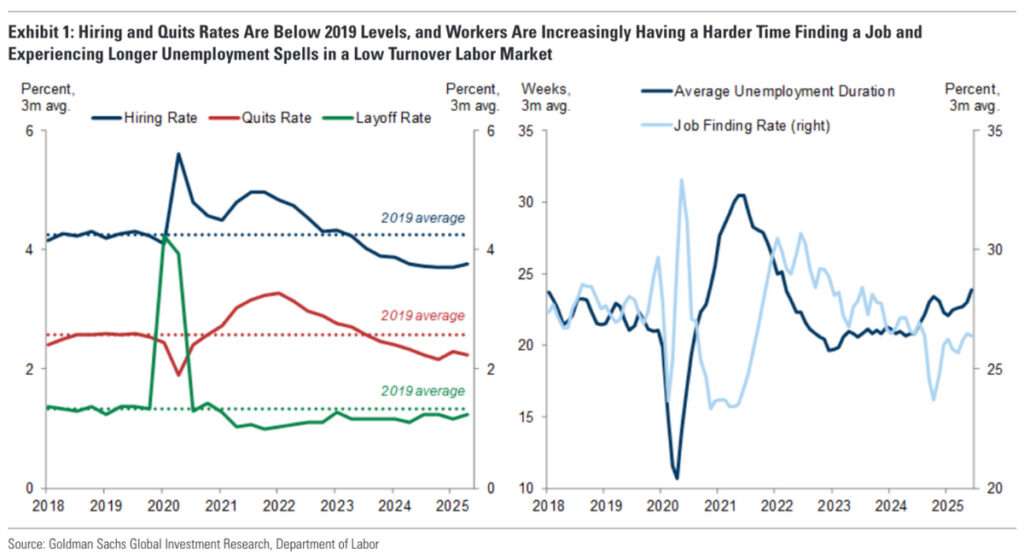

The wider economic backdrop helps explain why Bank of America’s hiring rate has fallen to just 1%. In September 2025, Federal Reserve Chair Jerome Powell described an “interesting labor market” in which “kids coming out of college and younger people, minorities, are having a hard time finding jobs.” He pointed to a period of low hiring and low turnover, conditions that disproportionately disadvantage new workers trying to enter the workforce.

When asked if AI was responsible, Powell called it “probably a factor,” pointing to a combination of slower overall job creation and some AI-driven substitution of tasks.

Economic analysis and hiring trends suggest AI is contributing to the decline in entry-level opportunities. Tasks that were once common in junior corporate and tech roles are increasingly automated. Handshake data shows entry-level corporate job postings have fallen about 15% year over year, while mentions of “AI” in job descriptions have increased roughly 400% over the past two years.

This creates a “double squeeze” for graduates: fewer traditional starter jobs, and those that remain increasingly require or prioritize AI-related skills.

The problem is no longer just access to jobs, but access to work that feels meaningful. Dartmouth economist David Blanchflower notes a rise in reported “despair” among young workers, even among those who are employed, alongside a growing sense of dissatisfaction with their roles. This erosion of morale amplifies the strain created by higher unemployment rates for recent graduates compared with broader labor-market conditions.

In response, many unemployed or uneasy Gen Z graduates are turning to additional degrees or specialized credential programs, effectively postponing full-time work in hopes of standing out in an increasingly crowded job market.

On AI’s long-term impact, Moynihan said it is still “too soon to say how it will play out.” He explained that Bank of America plans to reinvest productivity gains from AI back into the business, using those efficiencies to fuel future growth. “We want to drive more growth,” he said, adding that the benefits from AI would be spent on expanding the company.

Turning from the Federal Reserve to the private sector, Moynihan argued that business investment plays a far greater role in driving growth than incremental interest rate changes. “The idea that we’re hanging by a thread over the Fed moving rates 25 basis points feels out of balance,” he said.

Maybe you would like other interesting articles?