Taiwan Semiconductor Manufacturing Company (TSMC), the world’s leading maker of advanced AI chips, reported a 35% surge in fourth-quarter profit on Thursday, beating forecasts and setting a new record. The company also projected strong growth for the year ahead and pointed to a major expansion of its manufacturing operations in the United States.

Citing what it calls the “AI mega trend,” TSMC stated that demand signals from its customers and their end-users remain strong, leading it to forecast a nearly 30% rise in 2026 revenue in U.S. dollar terms.

The surge in AI demand has reshaped the balance of power in the chip industry, and TSMC is at the center of it. Already Asia’s most valuable listed firm, the company has become indispensable to the global tech supply chain, and with a market value around $1.4 trillion, it now far outpaces Samsung Electronics.

TSMC is accelerating its manufacturing expansion in Taiwan and the United States. Speaking at a press briefing, chief executive C.C. Wei said the company is applying for permits to build a fourth factory and its first advanced packaging facility in Arizona, where it has already committed $65 billion to three plants.

“We have acquired additional land in Arizona,” Wei said. “That should signal where we’re headed. We plan to expand multiple fabs there, and this gigafab cluster will help boost productivity, reduce costs, and better serve our U.S. customers.”

The move builds on TSMC’s announcement last year of a $100 billion investment in the United States, with signs pointing to further expansion. The New York Times reported that the U.S. administration is close to a trade deal with Taiwan that would lower tariffs and could include a commitment from TSMC to build at least five additional facilities in Arizona. Taiwan said on Thursday that such an agreement may be imminent.

With demand soaring, TSMC says it may boost capital spending by up to 37% this year, taking the total to $56 billion. The company also expects big jumps in spending again in 2028 and 2029.

Despite the bullish outlook, Wei expressed measured caution regarding concerns of an AI bubble. “We’re also very nervous about it,” he said. “We’re investing $52-$56 billion in capex. If we did not do it carefully, that would be a disaster for TSMC for sure.”

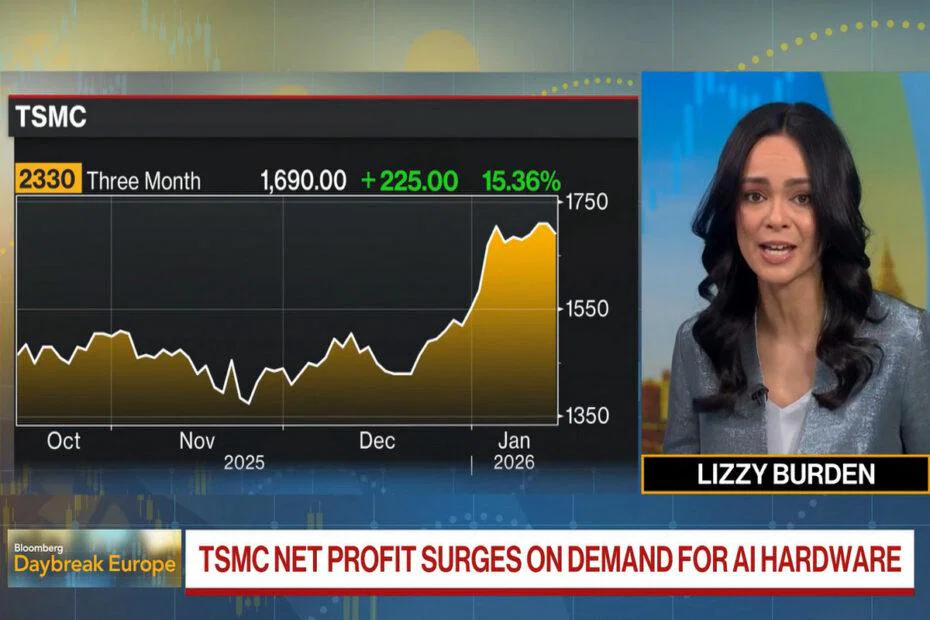

In the final quarter of 2025, TSMC reported net profit of T$505.7 billion ($16 billion), marking its seventh straight quarter of double-digit growth and beating analyst expectations. The company said first-quarter revenue could rise by as much as 40% from a year earlier to $35.8 billion.

Analysts say the results send a strong signal for the wider tech sector. “As companies like Nvidia, Broadcom and AMD compete for dominance in chips, TSMC stands to gain as the manufacturer behind all of their products,” said Ben Barringer, head of technology research at Quilter Cheviot.

After climbing 44% last year, TSMC’s Taipei-listed shares have gained roughly another 9% so far this year, a sign that investors remain confident in the company’s role at the heart of the AI boom.

Maybe you would like other interesting articles?